Is it going to be ‘computer says no’ or will the human dimension prevail?

19 september 2020

Data technology offers great opportunities to businesses. Insurers also increasingly base their acceptance policy on data analysis. “Technology has its limits, however. We are talking about assessing risks, implementing risk improvements and insurability here – a profession! That is not just about arithmetic, not by far,” Ron de Bruijn of Riskonet warns.

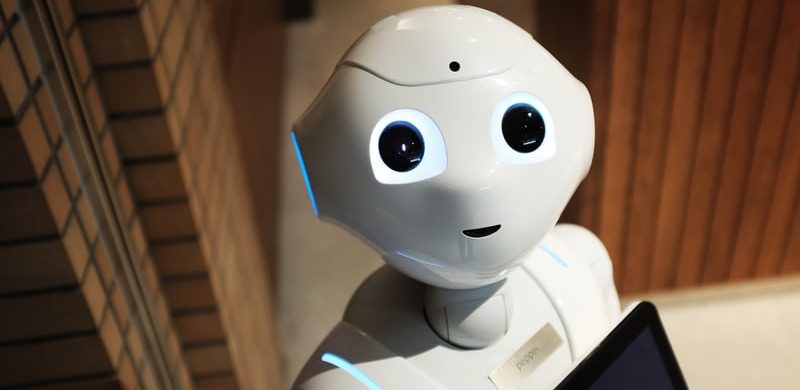

Riskonet questions the overly technocratic or data-driven risk approach. Situations at industrial companies cannot easily be ‘caught’ in simple models, while in the private market – with larger numbers – this can be done much more success. This means that for the time being, the ‘insurance robot’ will not make a successful entry into the insurance practice of enterprises. “For now, that robot would become pretty confused by the complexity of many companies, in which processes and measures form a highly dynamic whole,” Ron de Bruijn claims. “It is also difficult for a robot to make an assessment of cultural aspects and of risk-awareness in an organisation, let alone that it can see what effect a change of management has on the enterprise,” says Ruben de Bruin, who recently joined Riskonet after a career with insurers (including Zurich Benelux and AON) as well as enterprises (TBI Holdings and ING Real Estate). It is a fact that insurers do their best to increasingly include data analyses when assessing the risks and insurability and when determining and implementing the acceptance policy.

The human hand cannot be captured in a model

Riskonet founder Ron de Bruijn thinks that risk management is rather more than a sum of risks. “In the current market, the focus is on data models that calculate what is called the technical premium for an industrial segment. A very good starting point, but if there is not enough attention for the details, this will result in an unrealistic risk picture, that may turn out positively as well as negatively.” Ron knows cases in which the application of data models resulted in the technical premium threatening to become 30 per cent higher than before. “Without going too much into the details of this one example: the detailed analysis, taking interdependent factors and links into account as well, was lacking in the automated calculation model. It had become a black box. I call this the human hand, the analysis and appraisal of matters that can hardly be captured in a model. It is about experience, craftsmanship, a professional view of the case, and sometimes also a clear gut feeling.”

The automated practice is complex

The automated practice at an insurer, which results in an acceptance – or a requirement for measures – followed by a premium proposal, is complex. Ron: “If you assess different companies, there will always be differences that impact risks and insurance. This concerns details that can make an important difference. How does the organisation of a company work, what is the structure of the policy, what choices does the company make when it comes to risks, what is the directors’ view on this? These are elements that can hardly be included in models.” Ruben: “This also applies for contextual variables such as corona. Risks change because of a rapidly changing context. What model takes this into account?”

“In the current market there is a lot of focus on data models that calculate the so-called technical premium for an industry segment. An excellent starting point, but if insufficient attention is paid to the details, an unrealistic risk image arises that can have both a positive and negative effect."

Ron de Bruijn

Managing partner Riskonet

Making risk management part of the policy

Directors of companies that are faced with the expensive outcome of the black box are confused. “They do not get the hang of it and have no idea how they can still have any influence on the analysis, terms and conditions, and finally the premium,” Ron thinks. It is just like the memorable statement in the comedy series Little Britain: ‘computer says noooooh’ and that’s it. If it not possible to explain what a specific opinion on a business has been based on, an important risk management tool will disappear – and with it the possibility to ensure that the risk culture within a business develops in such a way as to make risk management part of the policy of an enterprise, instead of the imposed policy of an insurer or consultant.

Practical experience matters

It is not that at Riskonet they are afraid that technology will erode or threaten the company’s role as an expert and adviser. Quite the opposite. Ron: “Technological developments go fast. We need to keep a close eye on where this may offer advantages, now and in the future.” Ruben points out that the added value of experts can hardly be dispensed with. “The experience of many years helps when assessing and sensing, making the detailed analysis, focusing, correcting, and making a well-informed decision based on knowledge as well as experience. Risks in organisations are often about reaction patterns in companies between people. That may carry more weight than affixing the best sprinkler system or conducting a risk analysis. History has taught us that management actually should be a combination of man and system. Man has paid the price for this knowledge: the Space Shuttle exploded because of an imbalance between these two. The same applies for the nuclear disaster in Chernobyl, the credit crunch or loss-making construction projects.”

The importance of everyone’s role

In addition to the balance between people and systems, there is another essential element: the dialogue between insurer and customer. Every party has to play a role in this; there must be clarity of roles. The insurer deals with risk acceptance. The broker takes responsibility for the transactional part and is tasked with the duty of care. “The insured has to behave as a good client,” Ruben warns, “like, for example, this is also important with construction projects. Everyone who has insufficient knowledge in-house to fill the client’s role properly will have to find or engage it outdoors.” Riskonet likes to provide assistance in this regard, in many different ways. Ruben: “We are a risk improver and make customers’ risk developments transparent. The insights arising from this result in a much more fertile dialogue with the broker and the insurer. This enables parties to perform their roles better.”

Common sense

The risk management expert stands beside you, shoulder to shoulder. Ron de Bruijn: “We do not check whether the risk assessment, insurance and cost level fit the insurer, but place the customer centre stage. We help the customer arrange his insurability, but also ensure that he complies with laws and regulations, so the continuity of the enterprise will be safeguarded. Fortunately, providing advice on this is still a matter of professional know-how, experience, and a lot of insight.” That technology is getting an ever bigger role in this ‘arena’ is something that Riskonet gladly acknowledges and even embraces. At the same time, they advocate a proper appreciation of the human dimension, of sound advice, and of analysis carried out by professionals. Ruben: “Let’s not forget the lessons from the past. We certainly have to embrace technology, but also keep using our common sense.”