Integrated risk analysis with GAAS: seeing what others don’t

29 Juli, 2025

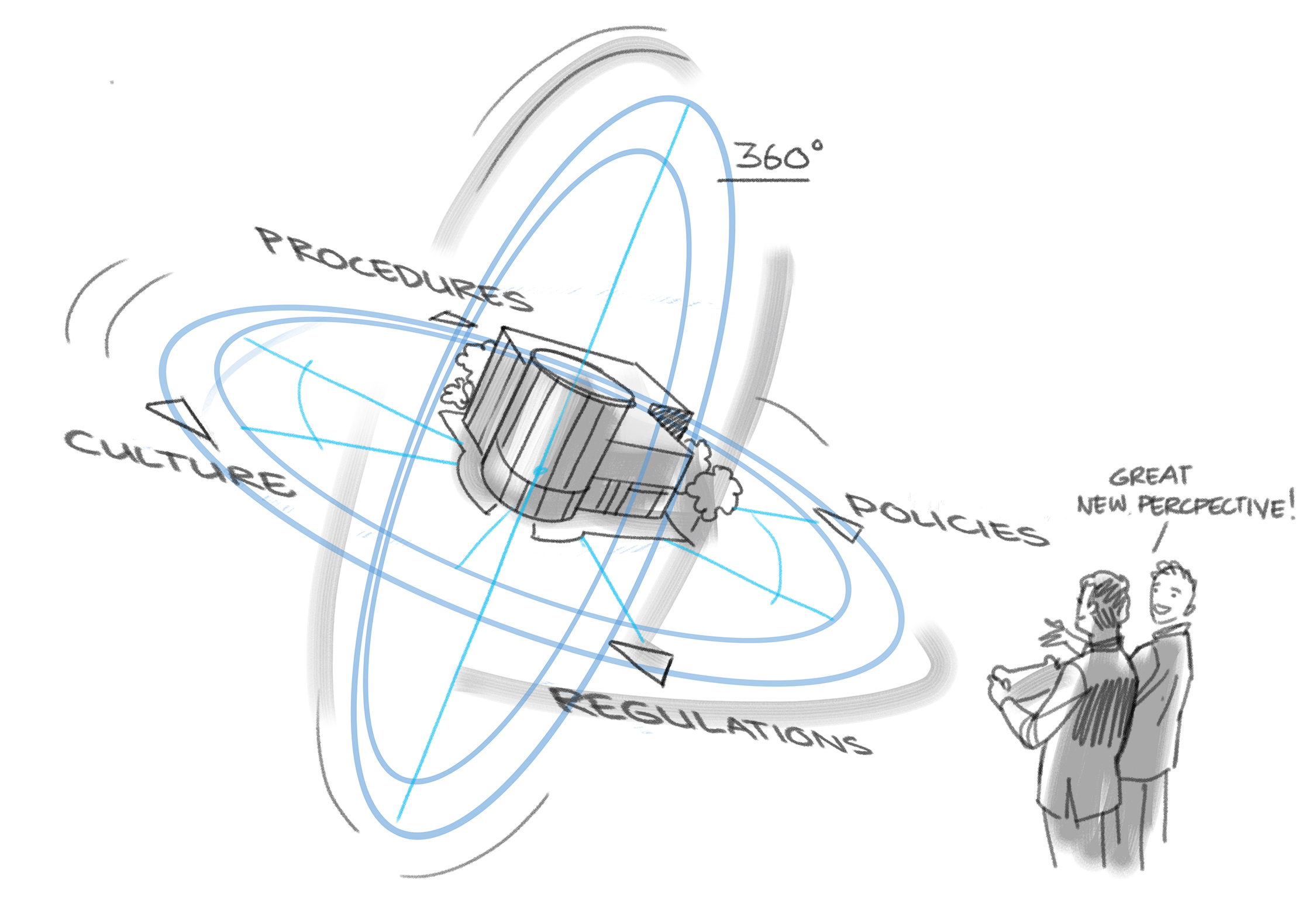

Three different advisors, three different opinions, the same commercial property. One expert focuses on legislation and regulations, another on insurability, and the third on business continuity. The result? Wasteful overlap, or worse, blind spots in the risk assessment. And it is for these reasons that Riskonet has developed the Gap Assessment Asset Safety model (GAAS).

The GAAS is a single, integrated risk analysis that reconciles three ostensibly disparate areas of attention into a clear and usable risk profile. “Many companies are failing to understand that the government’s priority is to underscore the safety of people, wildlife, and the environment — and not that of the company itself,” says Ron de Bruijn, managing partner at Riskonet.

Developed by Riskonet, the GAAS methodology gives a company a comprehensive overview of its material safety risks. Rather than taking the traditional fragmented approach, in which different advisors each focus on their respective areas, GAAS combines three crucial aspects: legislation and regulations; insurability; and business continuity. In addition to providing a company with insight into its current situation, GAAS also offers options as to how it can strengthen its position.

By way of illustration, De Bruijn cites a food wholesaler with expansion in mind. While his building plans seemed to comply with all the applicable regulations, the entrepreneur in question still had nagging doubts. To preclude possible problems further down the line, he approached Riskonet to carry out a more thorough assessment. “On paper, nothing could be faulted,” recalls De Bruijn. “But having looked beyond the applicable building-code requirements, it was clear that the building might be more difficult to sell or rent at a later date. A future user might, for example, place more stringent demands on safety and insurability than are strictly necessary. Furthermore, during our assessment we discovered that, with regard to legislation and regulations, there were still significant design shortcomings. And this was a design that had already been approved by the competent authorities.”

By making just a few targeted adjustments – which could more or less be implemented on a cost-neutral basis – the entrepreneur in question was able to retain flexibility, continues de Bruijn. “As well as increasing flexibility in the long run, this also avoids possible future disputes with insurers or potential buyers. We also consulted with the architect to see whether gaps in the area of legislation and regulations could be addressed.”

When is a GAAS risk analysis necessary?

An integrated risk analysis is of particular value at crucial moments for a company. Think here along the lines of expansion plans, for example, even if you comply with all current regulations. Or if the insurance market becomes tougher and you want to be well-prepared and knowledgeable when entering discussions with insurers.

A GAAS can make a real difference when it comes to discussions with insurers about premiums or coverage, clients’ enquiries about business continuity, or adjustments needed to comply with new legislation and regulations. “Too many entrepreneurs wait until problems arise, or only realise that issues exist when a government regulator points them out, or perhaps when an insurance inspector presents them with a long list of recommendations,” observes De Bruijn. “Being personally aware of the situation and what, if anything, needs to be done, puts you in a much stronger position during such discussions. It gives you ownership of a potential problem and thus the ability to maintain control.”

How does a GAAS risk analysis work?

A GAAS process usually begins when questions or issues arise as a result of legislation and regulation, insurability, or business continuity. “The government might tell you that you’re not complying with regulations, for example,” says De Bruijn, “or perhaps you have expansion plans. Alternatively, you might find yourself in a dispute with insurers, or a client seeks reassurance about the continuity of your business.”

Covering a variety of disciplines, Riskonet experts will then analyse all relevant aspects of the location. “We not only look at what the law mandates — in other words, what’s non-negotiable, we also investigate what might be useful for your company to add.” The focus always lies on the most critical aspects for the specific company.

Within a matter of just a few weeks, a report will be presented that can be used with all stakeholders. “Our client can use the information to satisfy its insurer, and will have all the necessary data to substantiate its risk profile.”

When and why was GAAS developed?

Riskonet developed the GAAS methodology because they were repeatedly encountering the same problem in practice, explains De Bruijn. “We kept seeing overlaps or gaps. Sometimes parts were missing, or we identified that the same issues were being addressed by several parties. We also saw that entrepreneurs were having to make investments on the basis of advice received from several sources, but that they only solved half the problem. Then, when another party came calling, additional investments were needed.”

The problem was the often-conflicting interests of the parties that were involved. While the government primarily focuses on the general safety of people, wildlife, and the environment, companies also have to deal with their own continuity and insurability. “Supposing there’s a fire at your company, but there are no casualties and it doesn’t spread to adjacent buildings. The government will be satisfied, but, in the meantime, you will have lost your business.”

What does a GAAS assessment offer?

The findings can vary extensively, depending on the situation. At one client, a food-production company, it emerged that while compartmentalisation effectively protects people, wildlife, and the environment, it does less for business continuity, and it isn’t always helpful in discussions with insurers.

De Bruijn also relates how Riskonet recently visited a medium-sized furniture company that had invested heavily in upgrading partitions that they thought would contain a fire. “Unfortunately, we had to tell them that their money wasn’t well spent because, even with these improvements, those partitions wouldn’t withstand a fire.”

At large corporations such as Royal Cosun and Plukon Food Group, Riskonet carried out GAAS assessments for all locations. “These assessments generated choices that would have been different had they focused on just one of the three elements.

What is so different about Riskonet’s GAAS?

The biggest differentiator is its integrated perspective. Riskonet’s competitors offer a piecemeal approach: building-code compliance; insurability; continuity. But, thanks to GAAS, Riskonet can offer a combined approach. One that brings immediate benefits. Companies are given insight into all relevant aspects, simultaneously, enabling them to make well-founded decisions.

At the end of the day, for companies, it’s all about control. Instead of having to react passively to demands from others, they want to proactively chart their own course. “And this is something we do a lot for our clients,” concludes De Bruijn. “Ensuring they can take and stay in control.”

Irrespective of whether it’s about expansion, insurance, or acquisition, GAAS will help your company make well-founded decisions that are based on a comprehensive risk assessment. No blind spots, no duplication – just control. Control over your security situation and your investments, both today and tomorrow.